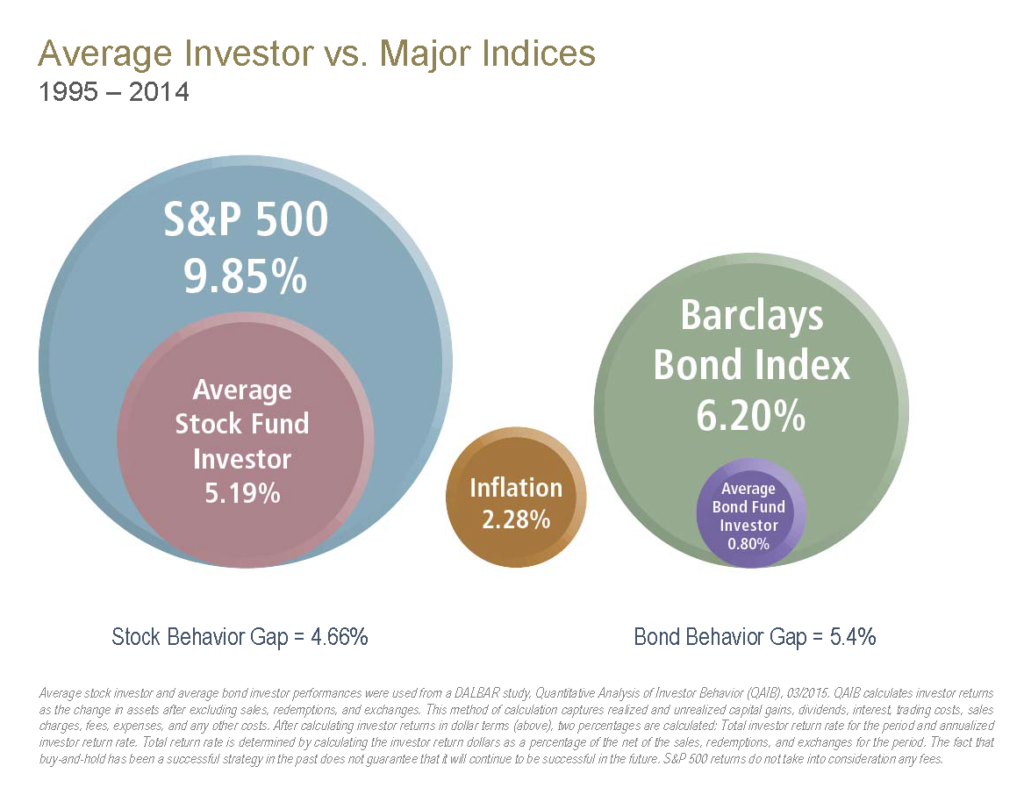

Why the difference you ask? When investors panic upon hearing/seeing the media overreact to normal (or even paranormal) market price gyration, and SELL their investments, they lack the strategy, the discipline to know when to buy again. Since the ‘sudden sale’ was largely emotional, so also, emotions keep investors on the sidelines until there’s sufficient ‘proof’ that it’s “safe” to get back in. That measurement of “safe” is often a sizeable uptick in market performance; 5, 10%, whatever, that this same sidelined investor MISSED by not having remained invested in the markets.

These days, market volatility is to be expected, and huge swings in prices (while alarming) are nonetheless NOTHING the average investor wants to attempt to “time”; so stay the course that you’ve devised—hopefully with the wise guidance of a Fee-Only CFP®–and ultimately while I can’t predict future performance, the history of the markets’ returns gives me confidence that if history either repeats itself, or rhymes, most people will earn sufficient returns to meet the bulk of their goals.