There’s quite the dilemma amongst some investors as to whether to invest their stock allocation of their portfolio into a combination of the USA and foreign stocks, or just to invest in companies domiciled in the USA. There’s the Home Bias, which many investors adopt, preferring to invest only in USA companies—realizing however that these days, many USA-domiciled companies are indeed multi-national, garnering percentages, and sometimes large percentages of their income, from outside the USA.

What with world politics and global uncertainty swirling in our headlines, should we be invested in the rest of the world—developed or emerging, and if so, in what percentages? While it can be very unsettling to read of all the negativity in the world’s countries and populations, with Zika having emerged as a medical and financial threat to much of South America, and the Brexit decision now upon us, what is a prudent approach to investing our hard-earned money?

What with world politics and global uncertainty swirling in our headlines, should we be invested in the rest of the world—developed or emerging, and if so, in what percentages? While it can be very unsettling to read of all the negativity in the world’s countries and populations, with Zika having emerged as a medical and financial threat to much of South America, and the Brexit decision now upon us, what is a prudent approach to investing our hard-earned money?

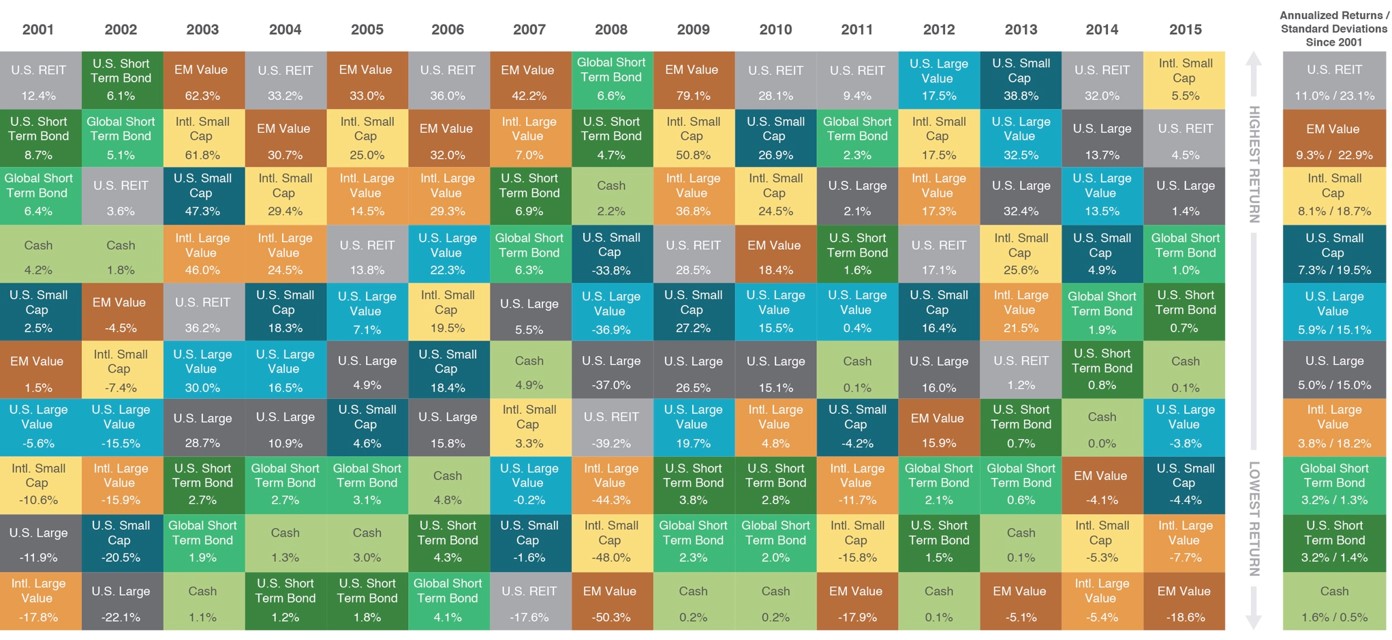

If we look back at the last 14 years of history as our guide, this chart tracts the annual asset class leaders from 2001 through 2015, listing each of their respective annual performance numbers. The foreign markets have indeed proven valuable diversifiers to USA-only holdings, sporting healthy double-digit returns in 2003-2006 and again in 2009 and 2010. Granted in 2012 the USA and foreign markets performance was too-close-to-call, yet in 2013 USA stocks beat their foreign rivals, and then trounced them in 2014, with 2015 showing a ton of red, international ink, comparatively.

I’ll cover the marked difference between Large company USA and foreign stocks and Emerging Markets, in a later post, yet in keeping with the historical cyclical nature of markets, it feels like we just may be poised to see foreign stocks emerge again over the next 1-5 years.

Be reminded that stock investments of ANY country, should be reserved for needs that are at least 7 year into the future, due to the extreme possibility of price volatility in the near-term. That said, for 7+ years; i.e., longer-term objectives, stocks have historically provided capital appreciation potential to help clients buy inflated-priced goods and services.