Ok, having earlier promised more information for those self-employed individuals, do consider bunching deductions into 2017—yes there’s still plenty of time–and possibly deferring discretionary income into 2018, IF you believe you will be in a lower tax bracket. There will be plenty of opportunity to Section 179 expense high-priced equipment purchases in 2018 (limit increased to $1,000,000), yet if you need the write off in 2017, go ahead and upgrade some of your equipment now, ensuring that the charge appears on your credit card, or you write a check dated PRIOR to 2017 year-end; i.e., by 12/31/17.

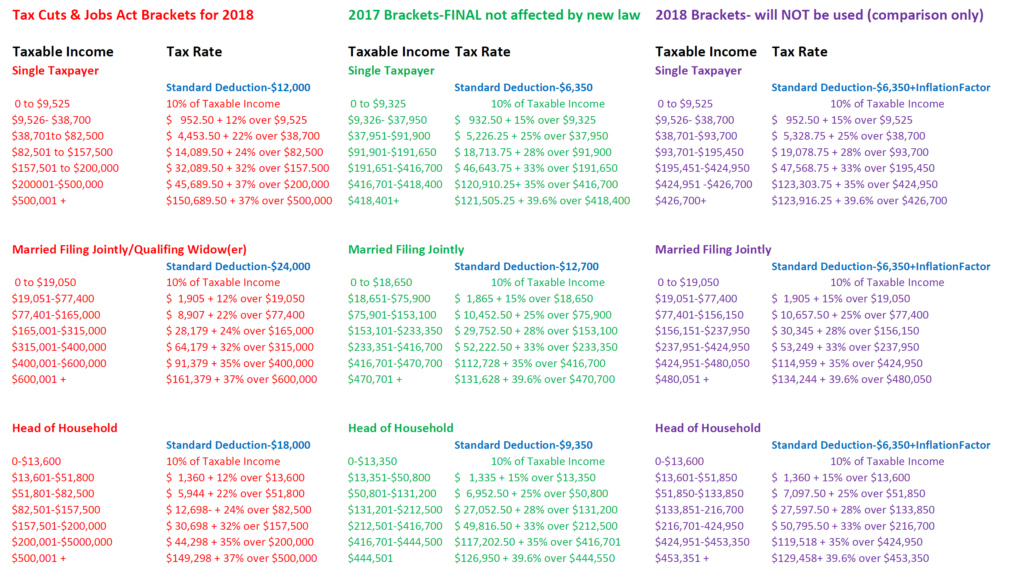

Below please find the tax brackets:

Click Image for PDF download

Click Image for PDF download

The far left columns will be effective beginning in 2018 according to the Tax Cuts and Jobs Act signed into law on Dec 22nd. The middle columns depict those tax brackets for 2017, which weren’t changed by the new law. The Right columns depict those tax brackets otherwise inflated for 2018, PRIOR to the Tax Cuts and Jobs Act being enacted; so these will not be used. We list them for comparative purposes only, so you can determine if the TCJA did you any favors, or not.

We’ve listed the standard deduction amounts as well, illustrating the increase afforded by the new tax law. While it has provided the GOP with a well-honed sound bite, it will effectively result in fewer Americans filing a Schedule A for their itemized deductions. That will inadvertently reduce the amounts many Americans otherwise contributed to charities, for one, and dis-incentivize home ownership, since the deductions for home mortgage interest are being capped and the deduction for Home Equity Line interest is now kaput/zero! Furthermore, considering that all Exemptions will be gone, the net effect of the Standard Deduction changes is strikingly small.

Please note that medical expenses will only be deductible under the TCJA for 2018 and 2019, to the extent your expenditures exceed 7.5% of your Adjusted Gross Income. (The 2017 thresh hold for deductibility is 10%; i.e., only expenses that exceed 10% of AGI will be deductible.) This will also mean many folks will lose their Long-Term Care premium deduction as well as folks deducting the monthly cost of assisted living expenditures in CCRCs.

I don’t expect the average, non-financial or legal professional to understand these nuances, yet suffice it to say, there are myriad sections within this 1097-page law affecting S-Corps vs. C-Corps/lowering of tax liability for certain pass-through business income/NOL deduction modifications/AMT pref items & higher exemption phase-outs/Excess bus losses/S Corp AAA distributions/Eligible Terminated S corps/ESBT charitable contributions/Partnership Technical Termination Rule/Section 1235/Like-Kind Exchanges/Cost Recovery/Bonus Depreciation/QBI deductions/Accumulated Earnings Tax(AET)/Trust Decanting/Pease limitations/Gambling Losses Limits and Real Estate Prop Taxes deductible in Section 212 businesses that won’t be fully unpacked for weeks or months to come.

A brief synopsis of what I believe are the Tax Cuts and Jobs Act law’s Winners & Losers.